The world of finance has witnessed a transformative wave with the advent of fintech apps.

From streamlining banking operations to revolutionizing personal finance, these applications have become an integral part of our daily lives.

Today the development of a fintech app has become a strategic move for many businesses.

As we step into 2024, understanding the cost implications of creating a fintech app is crucial for companies looking to venture into this thriving industry.

In this blog, we’ll explore various types of fintech apps and delve into the factors influencing their cost estimation.

Types of Fintech App and Their Cost Estimation

-

Banking Apps:

Banking apps have redefined the way we manage our finances. They offer features like account balance checks, fund transfers, and bill payments.

Cost Estimation:

The development cost for banking apps depends on the complexity of features, security protocols, and integration with banking systems.

Never miss an update from us. Join 10,000+ marketers and leaders.

On average, costs can range from $30,000 to $50,000.

-

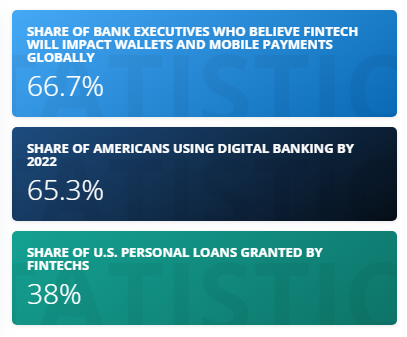

Mobile Payment Apps:

Mobile payment apps facilitate cashless transactions, allowing users to make payments using their smartphones. Examples include Apple Pay, Google Pay, and various regional apps.

Cost Estimation:

The development cost for mobile payment apps varies based on security measures, supported platforms, and integrations. Costs typically range from $15,000 to $25,000.

-

Digital Wallets:

Digital wallets store payment information securely, enabling users to make online and in-store purchases. They often include features like loyalty programs and rewards.

Cost Estimation:

The cost of developing digital wallets depends on features, security, and integrations. Costs can range from $15,000 to $50,000.

-

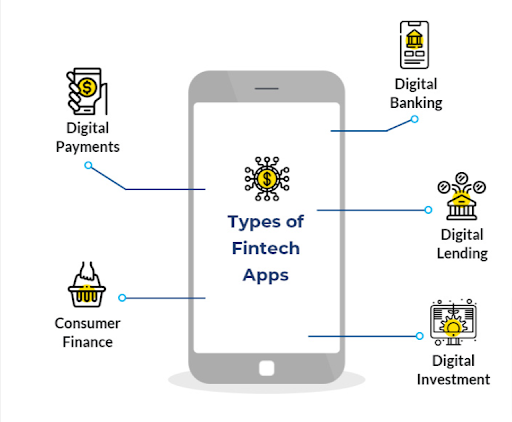

Lending Apps:

Lending apps connect borrowers with lenders, offering a streamlined process for loan applications and approvals. They may include peer-to-peer lending or traditional lending models.

Cost Estimation:

The complexity of the lending app, security measures, and regulatory compliance influence development costs. Estimates typically fall between $30,000 and $50,000.

-

Personal Finance Apps:

Personal finance apps help users manage their money, budget effectively, and track expenses. They often provide insights into spending patterns and financial goals.

Cost Estimation:

Development costs for personal finance apps depend on features like budgeting tools, expense tracking, and integration with financial institutions. Estimates range from $20,000 to $45,000.

-

Insurance Apps:

Insurance apps simplify the process of purchasing and managing insurance policies.

They may offer functionalities like policy management, claims processing, and premium payments.

Cost Estimation:

The complexity of insurance apps, compliance with regulations, and integration with insurance systems impact development costs. Estimates typically range from $35,000 to $50,000.

-

Investment Apps:

Investment apps provide users with a platform to invest in stocks, mutual funds, or other financial instruments. They often include features like portfolio tracking and investment advice.

Cost Estimation:

The complexity of investment app features, security measures, and integrations with financial markets influence development costs. Estimates range from $30,000 to $60,000.

If you want to develop a Fintech app to grow your business you should hire professional fintech app development services providers like Andolasoft.

The company following Fintech solutions:

-

Insurtech:

Insurtech, short for insurance technology, revolutionizes the insurance industry through technology-driven solutions.

Insurtech app development services focus on enhancing the efficiency of insurance processes, offering innovative policy management, claims processing, and personalized insurance solutions.

-

Wealth Management:

Wealth management app development services cater to individuals seeking comprehensive financial planning and investment management.

These apps provide features like portfolio tracking, goal setting, and personalized investment advice.

-

Digital Banking:

Digital banking app development services bring traditional banking services to the fingertips of users.

These apps offer features like account management, fund transfers, bill payments, and real-time transaction tracking.

-

Digital Payments:

Digital payments app development services focus on creating platforms that facilitate cashless transactions.

These apps enable users to make payments, both online and offline, using mobile devices or other electronic means.

-

Investment Apps:

Investment app development services target users interested in participating in financial markets.

These apps provide a platform for buying and selling stocks, mutual funds, or other investment instruments.

-

Personal Finance Apps:

Personal finance app development services focus on empowering users to manage their finances effectively. These apps offer features such as budgeting tools, expense tracking, and financial goal setting.

Developing a Fintech app can cost thousands if not millions; however if you need to develop cutting-edge fintech apps cost-effectively then contact Andolasoft.

Top Factors That Influence the Cost of Fintech Application Development

-

Project Scope and Complexity:

The cost of developing a fintech app is intricately tied to the project’s scope and complexity.

Determine the features and functionalities your app will offer, such as payment processing, investment tracking, or budget management.

The more intricate the features, the higher the development cost.

-

Technology Stack:

The choice of technology stack plays a pivotal role in determining costs. Consider factors like the platform (iOS, Android, or both), backend infrastructure, and database management systems.

Opting for the latest technologies may enhance performance but can also escalate expenses.

-

User Interface and Experience:

A seamless and user-friendly interface is a hallmark of successful fintech apps. Investing in a compelling design and user experience is essential, but it also adds to the overall development cost.

Balancing aesthetics with functionality is crucial for customer satisfaction.

-

Security Measures:

Given the sensitive nature of financial data, security is paramount in fintech app development.

Implementing robust encryption, secure authentication mechanisms, and compliance with industry regulations contribute to a higher development cost. However, it builds trust among users.

-

Regulatory Compliance:

Fintech apps are subject to various regulations and compliance standards. Staying abreast of these requirements and ensuring that the app aligns with them is imperative.

Compliance efforts may increase development time and costs, but they are essential for avoiding legal complications.

-

Testing and Quality Assurance:

Rigorous testing is vital to identify and rectify potential issues before the app goes live. Quality assurance ensures a smooth and error-free user experience.

Allocating sufficient resources and budget for testing is crucial for the long-term success of the fintech app.

-

Integration with Third-Party Services:

Many fintech apps integrate with third-party services like payment gateways, financial institutions, or data providers.

The cost of integration with these services should be considered, along with any associated fees or subscriptions.

-

Post-Launch Support and Maintenance:

After the app is launched, ongoing support and maintenance are necessary. Addressing bugs, releasing updates, and providing customer support contribute to the total cost of ownership.

Are you looking for a Fintech App Services

Allocating resources for post-launch activities is vital for the app’s sustainability.

Technologies Used to Develop Fintech App

Blockchain Technology:

Blockchain, the backbone of cryptocurrencies, has found extensive applications in fintech. Its decentralized and secure nature enhances transparency, reduces fraud, and facilitates seamless transactions.

Use Cases:

- Cryptocurrency and digital asset management

- Smart contracts for automated, trustless agreements

- Cross-border payments and remittances

Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML empower fintech apps to analyze vast datasets, gain insights, and make intelligent decisions. These technologies enhance personalization, fraud detection, and risk management.

Use Cases:

- Credit scoring and risk assessment

- Chatbots for customer support

- Fraud detection and prevention

APIs (Application Programming Interfaces):

APIs enable seamless communication between different software applications. In fintech, APIs play a crucial role in connecting with third-party services, financial institutions, and other data sources.

Use Cases:

- Integration with payment gateways

- Access to financial data for budgeting apps

- Connecting with external financial services

Cloud Computing:

Cloud computing provides scalable and secure infrastructure for fintech apps. It facilitates data storage, processing, and accessibility, enabling apps to handle varying workloads efficiently.

Use Cases:

- Secure storage of sensitive financial data

- Scalable computing power for high-performance apps

- Collaboration and data sharing among stakeholders

Cyber-Security Solutions:

With the increasing threat of cyber-attacks, robust cybersecurity is non-negotiable for fintech apps. Encryption, multi-factor authentication, and other security measures protect sensitive user data.

Use Cases:

- Secure transmission and storage of financial information

- Protection against phishing and malware attacks

- Compliance with regulatory security standards

Mobile Development Frameworks:

Fintech apps often target mobile users, making mobile development frameworks essential. These frameworks streamline app development, ensuring cross-platform compatibility and optimal performance.

Use Cases:

- Building feature-rich mobile banking apps

- Developing intuitive mobile payment solutions

- Ensuring a consistent user experience across devices

Data Analytics:

Data analytics empowers fintech apps to extract meaningful insights from large datasets. This, in turn, aids in making informed business decisions, understanding user behavior, and predicting market trends.

Use Cases:

- Personalized financial recommendations

- Market trend analysis for investment apps

- User behavior analysis for improved app performance

As fintech continues to redefine the financial landscape, the integration of advanced technologies is instrumental in creating innovative and secure solutions.

The synergy of blockchain, AI, APIs, cloud computing, cybersecurity, mobile development frameworks, and data analytics is propelling fintech apps into the future.

By leveraging these technologies, businesses can not only meet the current demands of the market but also stay agile and adaptive in the face of evolving financial landscapes.

The future of fintech is undoubtedly intertwined with the relentless pursuit of technological excellence.